IRS Tax Reform Information Technology Team

Department of the Treasury

Nancy Sieger

Nancy Sieger

Rob Bedoya

Rob Bedoya

Tracy DeLeon

Tracy DeLeon

Craig Drake

Craig Drake

Kenneth Corbin

Kenneth Corbin

Nancy Sieger

Rob Bedoya

Tracy DeLeon

Craig Drake

Kenneth Corbin

The Tax Cuts and Jobs Act of 2017 (TCJA) directed the most sweeping reform of U.S. tax law in 30 years, and the Internal Revenue Service (IRS) had to move quickly to put these changes in place. The Act contained hundreds of provisions providing relief to help taxpayers and the nation’s business community.

While putting in place TCJA provisions, the IRS and the Treasury Department were keenly focused on ensuring taxpayers and tax professionals were able to navigate and understand the required changes. The Act involved creating or changing an unusually large number of forms and publications, updating scores of tax processing systems, retraining the IRS workforce and educating the public. The implementation challenges were significant enough that the Treasury Inspector General for Tax Administration (TIGTA) and others warned of the potential delay to the filing season by weeks.

A critical part of the success in delivering the tax reform changes came from the IRS Tax Reform Information Technology Team.

“This was an enormous undertaking for the entire IRS organization under demanding deadline pressure,” said Nancy Sieger, the acting IRS Chief Information Officer and one of the honorees. “This effort required intense coordination between our IT function, the agency’s business units and the Chief Counsel organization. It was a team effort.”

“Working together, the IRS delivered for the nation’s taxpayers,” said Ken Corbin, the IRS Wage and Investment Commissioner and another honoree. “Our goal was to simplify the experience for taxpayers and our partners in the tax industry to make it as easy as possible for them to fulfill their tax obligations quickly and accurately.”

Other honorees included IRS IT leaders Robert Bedoya, Craig Drake and Tracy DeLeon. The team and many others in the IRS successfully translated broad tax policy goals from Congress into tangible computer programming changes for IRS technology systems. They persevered through many formidable obstacles, including timing, retroactive applicability of tax provisions, complex system interactions, leadership transitions and significant workforce attrition, among other challenges.

In addition to TCJA changes, the team supported the successful effort to completely modify the existing Form 1040 series. As a result of their work, TIGTA noted that the IRS successfully completed extensive programming and systems changes in a compressed timeframe to meet deadlines for the 2019 tax filing season.

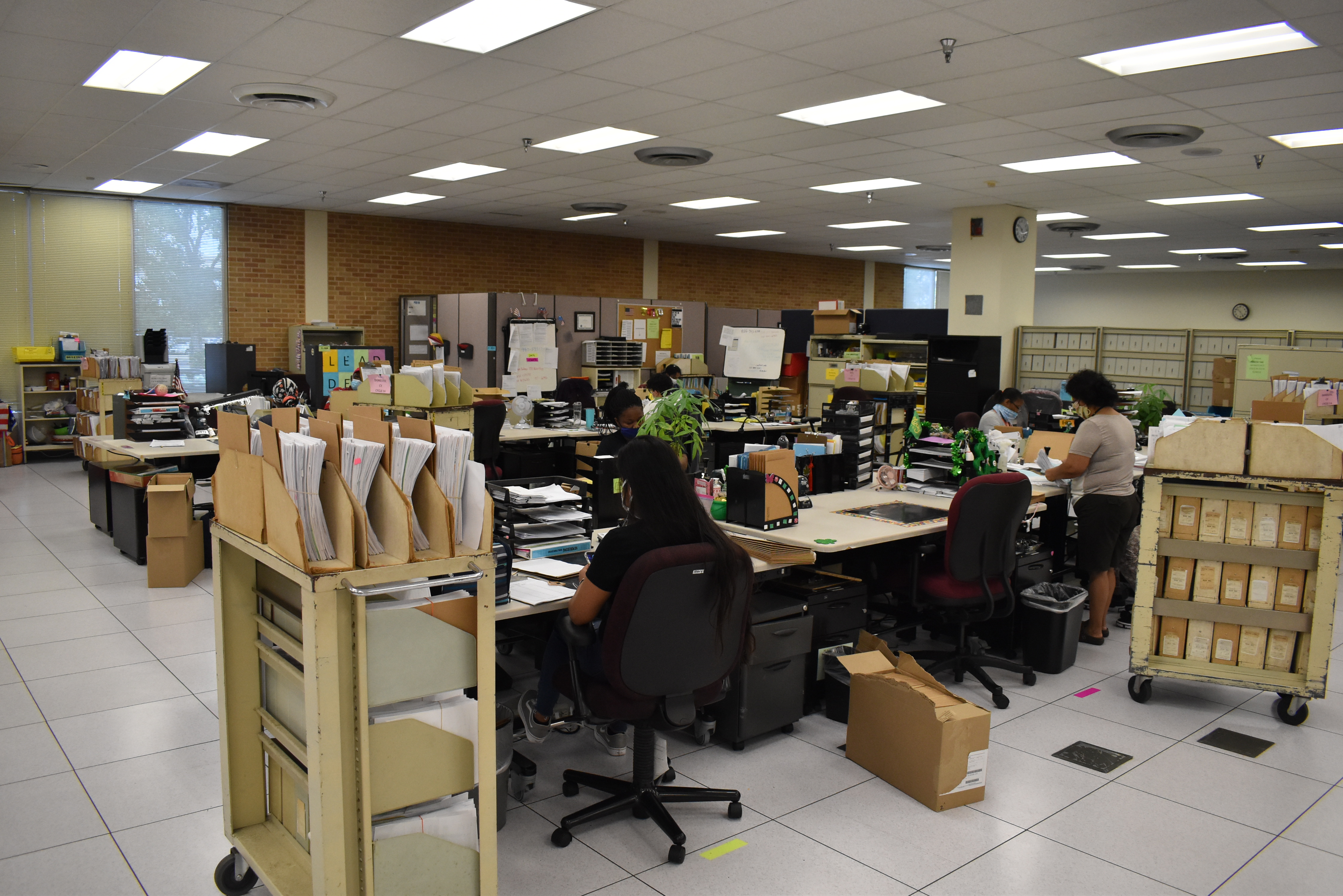

And despite uncertainty from other tax provisions and other factors, the team led the update of more than 140 information technology systems and more than 500 corresponding tax products - twice the amount in an average tax year. Their work involved planning, reprogramming and testing of those systems to successfully protect the IRS network and taxpayer data, as well as protect against tax fraud.

“As the agency has done for years, when a major tax law provision or national crisis occurs, IRS employees deliver for the nation,” said IRS Commissioner Chuck Rettig. “The collaborative efforts of our tax reform team and the IRS workforce is another in a long line of successes delivering for the nation under demanding timelines and making a difference for taxpayers in a time of need. ONE IRS, proudly serving the people of our country.”